Investment Solutions

Money Manager X-Change (MMX) helps you to provide your clients with access to high-quality investment management, while helping to make your business more efficient.

Money Manager X-Change Video

Like many financial advisors, you may be considering third-party money managers for the investment management of your client portfolios.

You like the idea of expanding your investment offering to clients…you see outsourcing as a way to increase your efficiency and make your business more scalable….or you see it as a means of lowering your investment-management-related overhead.

Whatever the reason, the Money Manager X-Change, or MMX, program is a convenient way to use third-party money managers and strategies to meet clients’ investment needs.

Whether you outsource all your investment management or round out your offerings with complementary strategies and money managers, the MMX program is an excellent resource for your business.

Available on the Liberty platform, MMX provides a convenient UMA structure that enables you to use multiple managers, models, or strategies in a single account.

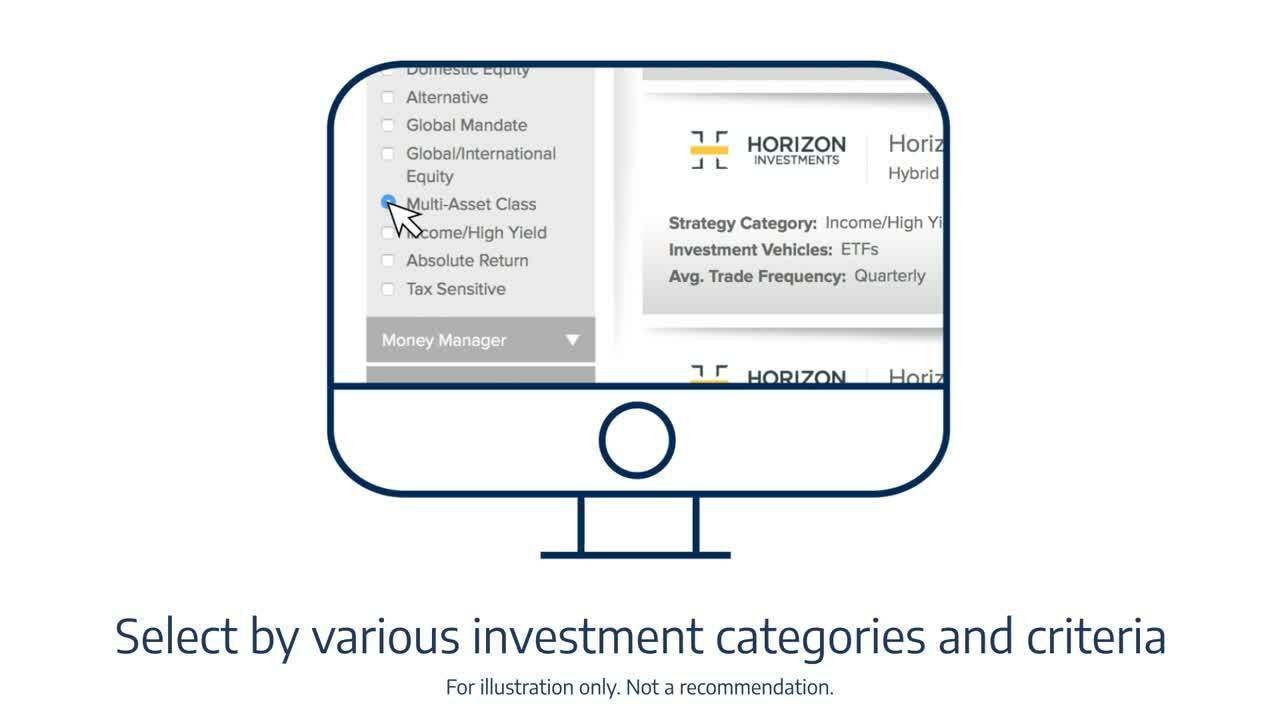

With MMX, you’ll select from a list of leading third-party money managers and strategies, including mutual fund and ETF strategists, pure stock models, strategic and tactical management styles, holistic asset allocation models, and other specialized strategies to meet clients’ unique needs.

Once you’re set up, you can add or subtract money managers from an account without having to open a new account. You can also report performance at the model, account, and/or household level. And you can tax trade your clients’ investments. You can even customize fees to specific assets, models, or strategies within an account.

Pre-established pricing is available for our select money managers, so you can start delegating investments quickly and easily.

And, because MMX is available on the Liberty platform, it provides:

- Easy client onboarding with a simple - new account application with e-Signature capability.

- Built-in performance reporting with multiple options for reviewing account holdings, allocations, and households in a single view.

- A robust, integrated fee-billing engine.

- Account aggregation so you can view and manage your client’s entire financial picture.

- An open architecture structure that enables integrations with popular third-party technology, including CRMs, financial planning, and risk-profiling tools.

- And, private labeling of your client portal, statements, and reports.

To learn more about MMX and how we can help integrate this feature easily and seamlessly into your business, contact us today.

Powered by the Liberty Platform

For advisors, one of the biggest benefits of working with Axos Advisor Services is the efficiency the technology platform provides. And it’s no different with the MMX program. You have access to powerful investment management capabilities right from the Liberty platform.

Delegate all of your money management or just a portion

Retain control of which managers and strategies are available to advisors

Create multiple-model portfolios in the same account

Leverage your money managers’ investment expertise without the hassles of buying signals

Choose from a list of select managers with dozens of investment strategies

Add your own third-party money managers to the program

Benefits of Money Manager X-Change

Supplement your existing strategies to create more diverse investment offerings to help meet your clients’ needs, goals, and preferences.

Pre-qualify and select the high-quality money managers you want to work with.

Become more efficient by employing an easy process of hiring multiple money managers through one source.

Lower investment management-related overhead while maintaining complete control over your client base.

Benefits for Your Advisors

Provide advisors with the flexibility to choose from the MMX options that you have selected and customized for them.

Enable advisors to build a team of money managers whose strategies resonate with them and their money management style.

Give advisors more ways to help meet the needs of their clients through a more robust investment management offering.

Provide scalable models for small accounts.

Benefits for Clients

Provide more investment options for unique and varying needs.

Access strategies focused on specific market niches, investment types, or changing market conditions.

Access sophisticated money managers that were once restricted to just high net-worth clients.

Provide 24/7 online access to investment holdings, transactions and performance in one place and in one consolidated statement.

Let’s Talk About What We Can Do For Your Business

Call us at 866-776-0218 or complete a request for more information.